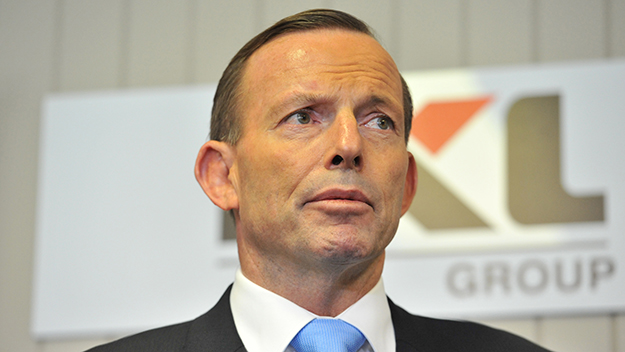

On the condition of anonymity, a senior figure of Mr Abbott’s Liberal ministerial team told the Sydney Morning Herald that the suggestion of a tax could become “Tony’s Gillard moment, when she announced the carbon tax”.

The Prime Minister admitted to considering a levy to help reduce the nation’s debt on radio earlier in the week.

“There’s been speculation, as you know, about a deficit reduction levy,” the Prime Minister told Fairfax Radio.

“Certainly it is my intention that people like myself, high-income earners, should bear a significant quantum of the burden when it comes to sorting out our problems.

“We do have a short-term problem and we do need to deal with it,” added the PM.

Although there has been no official announcement, the impending deficit levy – expected to be introduced in the May budget – threatens to rip apart Tony Abbott’s credibility after he was elected on the back of an election mantra insisting on no new taxes.

The deficit levy is touted as a temporary lift in tax thresholds for incomes above $80,000 a year.

In an effort to water down speculation that the new income measures will result in an $800 annual levy on average workers, senior government sources told The Daily Telegraph yesterday that the most likely changes would be a one per cent rise in the tax.

In layman’s terms, the new changes propose that for people earning $80,000 a year – currently paying 37 cents in every dollar of income tax, plus 1.5 per cent for the Medicare levy – they now will face an extra one per cent for the deficit tax that increases that tax rate to 39.5 per cent. This effectively means they will be paying up to 40 per cent on July 1 when the Medicare levy is raised by two per cent to moderately fund the National Disability Insurance Scheme.

Following the same logic, for those who earn $180,000 per annum and currently pay 45 cents in the dollar (plus the 1.5 per cent Medicare levy), their tax rate will jump up to 48.5 per cent or 49 per cent after the July Medicare levy increase.

According to the ABC, Queensland LNP senator Ian Macdonald says he knows Mr Abbott will stand by his commitment of “lower and fairer taxes” but did express concerns that any levy on individuals would bypass big business and put small business owners at a disadvantage.

“A scheme where the butcher and the baker as individuals will have to pay a levy, but not Woolworths and Coles, who are competing with the local butcher and baker, I think that is unfair,” Senator Macdonald said.

In reaction to the impending tax Labor’s opposition, Opposition Leader Bill Shorten criticised the Abbott government of defaulting on promises made before the election.

“They’ve doubled the deficit, now because they’ve doubled the deficit they want all Australians to pay a deceit tax,” he told reporters in Brisbane.”

Political commentators suggest the Liberal Paid Parental Leave was initially estimated to cost $5 to $6 billion a year – double the amount the dreaded new “deficit reduction levy” is suspected to raise.

This afternoon the PM announced a government backed $155 million growth fund for jobs in Geelong and Victoria.

Today Mr Abbott refused to speculate further on budget announcements, but did reiterate the sentiments of his treasurer, Joe Hockey, who last week told a crowd at Sydney’s Doltone House that Australians need to develop a “need for greater self-reliance” instead of being government-dependent.

While taking questions today, Mr Abbott did not deny any plans to roll out a new tax to fix what he called “a budget emergency”.

“A lot of things have to be adjusted and everyone is going to have to do their bit to deal with the problem that we have inherited”.

Related: Tony’s tax: a play on words