It’s not usually one of our favourite things to talk about, but superannuation has become a hot topic in this year’s federal election campaign.

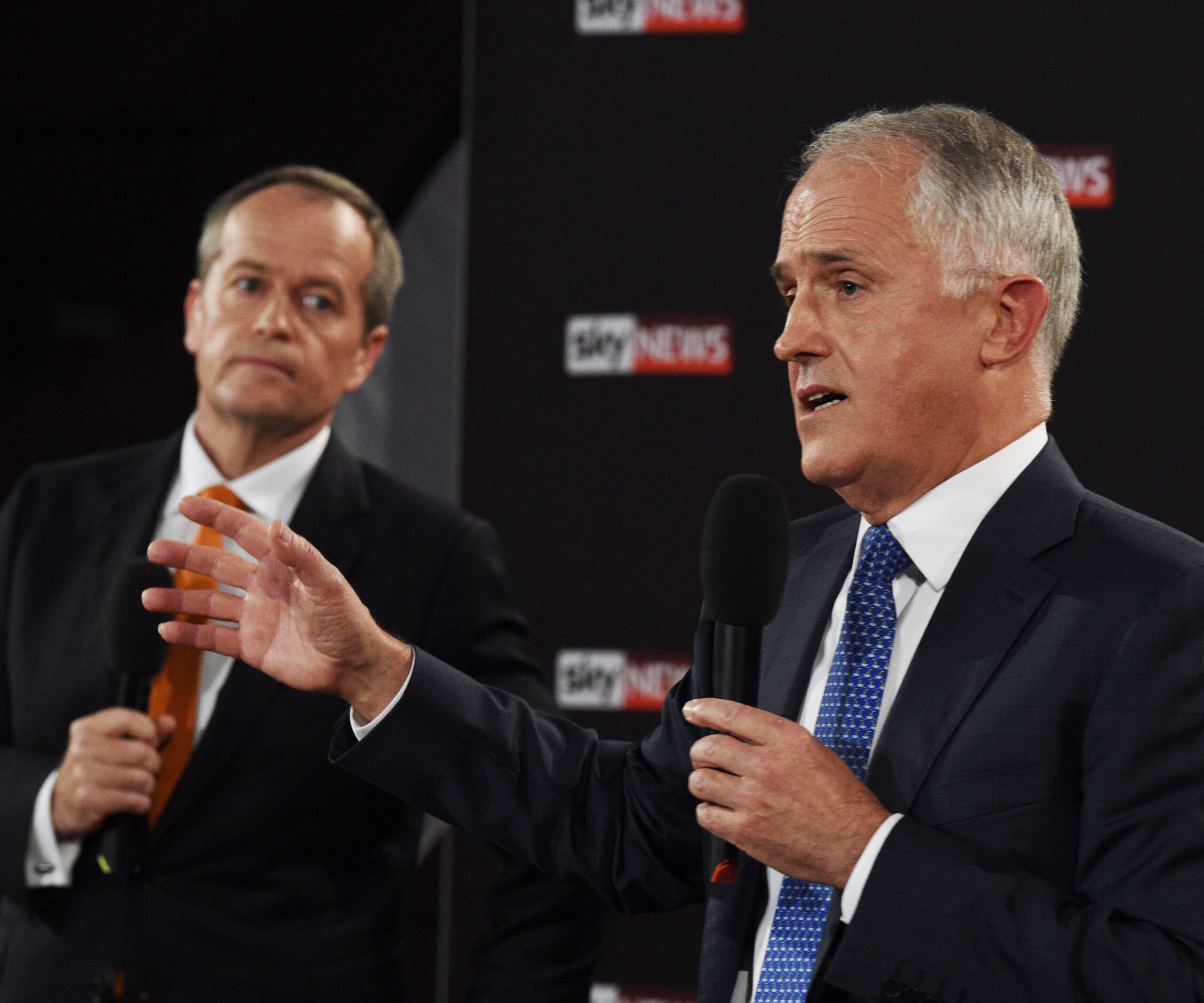

That’s because the Coalition Government and the Labor Opposition have both committed to reducing the benefits that wealthy retirees get from the way the superannuation system currently works.

In recent years, governments have encouraged workers to pour as much money as possible into superannuation in the hope that fewer people would have to depend on the aged pension once they retired. A reduced tax rate, called a concessional tax rate, was introduced on the money that our superannuation accounts earn, as an incentive.

But canny accountants worked out that this was a great way to reduce the tax bill for high-income earners, who would pay only the 15 per cent concessional tax rate on the money being earned by their multi million dollar super funds instead of almost 50 per cent if the money was earning interest in a bank or some other investment.

Labor was the first to announce it would change superannuation tax to “make the wealthy pay more” if it won government.

Back in April, the Opposition announced that from July 1 next year, a retiree’s super account could earn up to $75,000 a year without having to pay tax, but every dollar earned over that amount would be taxed at 15 per cent. A retiree would need to have about $1.5 million in their super account to earn that much.

And for people even further up the income scale, Labor would double the tax on superannuation earnings above $250,000 to 30 per cent.

The Government announced on Budget night in May that it would also make changes to superannuation if it was re-elected.

These include putting a $1.6 million cap on super accounts, so that high-income earners can’t use their fund as tax dodge.

Anyone with more than this amount in their super fund would be required to remove the excess amount, which could then be invested in another type of retirement saving plan. However the full amount of tax would have to be paid on anything earned by that investment.

There would also be a crack down on large amounts of money being funneled into super accounts, with a new $500,000 limit to be put on people making extra payments to their super funds.

And like Labor, the Government would double the tax to 30 per cent on superannuation earnings that are more than $250,000 each year.

It is important to remember the tax increases being proposed by the Government and the Opposition apply only to what a super fund earns, not the total amount of the super fund. The Government believes only four per cent of Australian retirees will be affected by its superannuation tax proposal.

The Government also announced on Budget night that it intends to make some changes to superannuation that will particularly benefit women.

Around two million women on low incomes would be provided with a refund of the higher taxes they pay on some super contributions.

Women with less than $500,000 in super would also be able to make “catch-up” contributions to their accounts and high-income spouses would be allowed to put more funds into their low-income spouse’s super.

Assistant Treasurer Kelly O’Dwyer confirmed in recent days that transition to retirement pension schemes would also be required to pay 15 per cent tax on any earnings.

We do not know at this stage whether the Government will review this proposal following an outcry by some media commentators about it.